An understanding of payment fraud can be key to its effective prevention. From this article you will learn:

- what payment fraud is,

- several popular payment scam schemes,

- how to react a payment fraud;

- how to mitigate the fraud risks;

- why it is important to use the verified payment system.

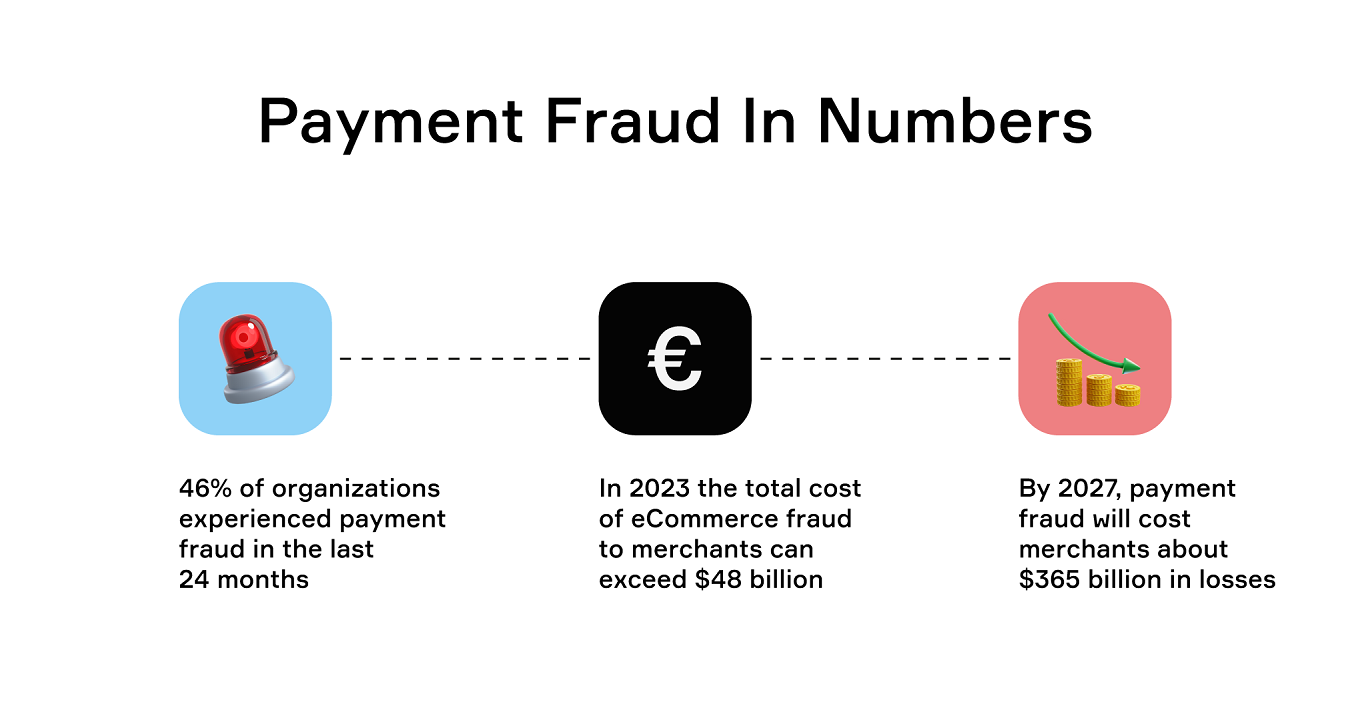

Payment fraud in numbers

Payment fraud exists for ages. We can suppose it appeared together with the first money. Here we discuss payment fraud in online banks and digital payment systems. In PwC’s Survey on global economic crime and fraud, 46% of organizations reported they experienced payment fraud and other cybercrimes in the last 24 months.

Cybercriminals are a serious threat to the global economy. Only in the United States, online businesses lose approximately $5.8 billion in 2021 because of scams. In 2023 the total cost of eCommerce fraud to merchants can exceed $48 billion.

By 2027, payment fraud will cost merchants cumulatively more than $365 billion in losses. Just imagine that the tech typhoon Apple reported a $95 billion net income in 2021. So, the amount of potential loss equates to almost 400 percent annual income of one of the largest global brands.

How payment fraud works

Fraudsters use every new and old technology to obtain personal or business-sensitive information illegally. Here is a short list of modern technologies that can be used to get sensitive information.

Email Scammers

send an email with a phishing link or attached malware. When a user opens it, it installs the malware or redirects to a fake site to steal login credentials. So it is not recommended to open an email from unfamiliar senders, extract the attached archives and click the links.

Malware SMS

These SMS can look reliable because they pretend to be sent by banks, e-shops, and other resources, but they include a link to malware and work as the previous scheme.

Instant Messaging

In the incoming messages, a user can get a link to malware, a fraudulent site, or a money request from a stolen account.

Phone Calls

The criminals call potential victims and try to convince them to disclose their credit card data, or just make a payment to some account.

Traffic Rerouting

A script redirects users from a legal website to a fraudulent one to steal personal or business information.

Some complex technical methods allow penetrating the payment systems via vulnerabilities or glitches. If the hacker finds a vulnerability in the security system, the damage from an attack can make millions.

Payment fraud: Popular schemes

Sad but true: there are hundreds and thousands of payment fraud schemes. Some of them do not require complex technical solutions and use psychology only. Others are complex and hardly detectable. Let us review some popular payment fraud types.

Social Fraud

Probably, each of us faces this or that type of social fraud because there are plenty: Ponzi schemes, fake charity, airplane ticket scams, and so on. The only common feature in all social frauds is that the individual makes a payment voluntarily to criminals who fade away soon. Unfortunately, technical methods cannot prevent most types of social fraud.

Phishing

This is the theft of personal or private information online, like credit card numbers, login credentials to a bank account, and other data. Using stolen information, criminals can transfer money to other accounts or buy some products online.

Identity Theft

A complex action that includes various criminal activities using the victim's name. Cybercriminals can steal a copy of documents, banking information, social security number, and even the names of relatives and pets to answer a secret question and access the account.

Pagejacking

This is a pain point for eCommerce businesses. When the user visits the e-shop and starts the purchase process, a fraudulent script redirects a visitor to a different website. Criminals can sell counteract products or use various malware to steal private information.

Moneyback Scams

This is a very simple scam but it often works. A cybercriminal registers on the service with a high number of daily transactions and then asks for money back for a product that has been never purchased.

Stolen Credit Cards Scam

When criminals use stolen credit cards, they can create a merchant account and pretend to be a legitimate business. Then they charge stolen credit cards as a merchant for fake purchases to fly under the radar. When a cardholder notices the fraudulent payments and asks for money back, a fake merchant account vanishes.

As you see, there are many payment fraud types, and new ones appear one by one, with endless competition with anti-fraud technologies. However, now the payment protection has made a step forward, and we will discuss this below.

How to detect payment fraud

Till recently, the major method of payment fraud detection was the user report. If the victim noticed the unauthorized payments quickly, it was even a chance to interrupt the crime and return the money.

Nowadays security systems use modern solutions, like multifactor authentication or machine learning, to detect unusual or suspicious activities. Machine learning and artificial intelligence together demonstrate impressive results. Now the security system can automatically detect the unusual user location, a payment to a compromised website or account, or an unusually large amount.

However, here is a dilemma. The clients do not like complex solutions. Moreover, most of them are not happy with the additional security measures that interrupt their normal life. For example, a payment system blocks the transaction because the client is logged in from another country. The client just arrived for a vacation, and instead of enjoying the time, communicates with the bank support team. Even if the problem is solved quickly, the client remains unsatisfied.

When the payment system becomes too complex, the clients start looking for another option. So, the anti-fraud system should be almost invisible to the clients.

How to prevent payment fraud in your organization

Probably, there are no absolutely secure systems, and it is impossible to predict all vulnerabilities and fraudulent schemes. However, 90% of scammers use old and well-known schemes for fraudulent payments, and you can mitigate the risks with some standard security measures.

Keep Your Software Up-to-date

It is necessary to keep your firewall and antimalware applications updated, download new virus bases and pay for a license or subscription in time. However, cybercriminals can access your computer with other methods, for example, using a browser vulnerability. So, do not reject the system and software updates at all.

Make Regular Security Checks

Set up regular security checks on your personal and all corporate computers. Do not ignore warnings and remove all suspicious files and applications.

Encrypt Your Information

Make sure your system uses encrypted payment protocols and sends only encrypted data.

Use a Multifactor Authorization

Set up a multifactor authorization for all important applications and systems to reduce the risk of unauthorized logan.

Train Yourself and Your People

Simple security rules decrease the risk of losing your money: do not use primitive or repetitive passwords, keep your device hidden by joining the open wi-fi network, do not save your login credentials on public computers, and so on. Follow the security rules and make sure your team also uses them because most payment frauds occur because of the human factor.

Change Passwords

Change your password, especially if they are relatively simple. In the organization, set up regular password updates for all employees.

Keep a Physical Security

Some criminals can access vulnerable or private information just after logging in to your network, for example, in the office. Do not allow strangers to access the corporate computers or network.

Find a Reliable Payment System

Each business needs a reliable payment system, and the market responds with numerous propositions. Unfortunately, fraudsters often act as a real payment system. So, partner only with verified payment systems, like Corytech.

How to respond to a payment fraud

Respond Immediately

If you have noticed or reported an unauthorized transaction, respond immediately. Report the cybersecurity department and other units in your company that are responsible for fraud protection. Make sure they follow the security protocols. If you run a small business and do not have internal cybersecurity specialists, contact your bank\payment system and follow their recommendations.

Contact Your Bank\Payment System

Whether the fraudulent transaction occurs with your bank account or in the digital payment system, notify the support team immediately or make sure your staff does it. In some cases, bank or payment system support can block a suspicious transaction and break a payment fraud attempt.

Document the Process

Create or initiate the creation of incident detailed documentation. Despite the result of the incident, you’ll need to investigate it and react correspondingly.

Maintain Internal Control

Make sure that anti-fraud procedures exist in your organization and that they are followed by all employees. The best procedures are nothing if people ignore them.

Check Corporate Banking Statements

Initiate the bank or payment system statement audit for any unusual activity in the last three months. If detected, add it to incident documentation.

Maintain Protective Software Audit

If the problem is on your company's side, maintain or initiate the antimalware applications audit, update, and replacement.

Consider Another Payment System

Sometimes the problem is not on the client’s side. If your bank or payment system faces repetitive payment fraud, you’d better find a more secure organization or system.

Corytech to mitigate payment fraud swiftly

Partnering with a reliable payment system is an essential part of payment fraud protection. Corytech can be your partner because we provide a comprehensive suite of online payment solutions for businesses. We follow all the modern security standards and we have zero record of successful hacker attacks due to our anti-fraud system.

As we mentioned above, users do not like when security measures interrupt their activities. Our security system works flawlessly, so our clients and end users rarely notice it. As a rule, they face the security system work when it suspends the suspicious transaction. However, it happens rarely because our machine learning systems analyze users’ activity and react only in unusual cases.

So, a partnership with Corytech can be an answer to the payment fraud risks.

Payment fraud FAQ

What is Payment Method Hijacking?

Payment method hijacking is a type of fraud when cybercriminals take control of a payment system and steal money redirecting the payment to a fake account.

What Are Transaction Frauds?

Transaction fraud is a scam when cybercriminals steal credit card information or online payment system credentials and make unauthorized transactions.

What Are the Red Flags of Fraud?

These are the conditions, situations, or actions that can result in fraud, waste, and abuse of resources. An example of a red flag is the absence of transaction history in the payment system or a request for some personal data.

What’s Next?

As you see, the risk of facing payment fraud is high. If you run an e-business, especially an e-shop, cybercriminals will attack you one day. Even if you are small, it does not matter: criminals attack all.

However, facing payment fraud does not necessarily mean becoming a victim. You can mitigate the risks and prevent payment fraud, by following several rules. Educate yourself and your staff, use the updated protective software, do not allow strangers to assess your computer network and partner with a reliable payment service vendor.

Corytech will help you to provide a safe and secure service to your customers. Our anti-fraud program works effectively and almost invisibly for the end users.

Request a demo to get detailed information about the anti-fraud system and other Corytech benefits.

Home

Home

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)