In today's world, online transactions have become an integral part of doing business. To facilitate online payments, businesses need a secure and efficient way to process transactions. This is where payment gateways come in. This article will explore the importance of payment gateways in business and provide insights into choosing the right payment gateway for your company.

Understanding payment gateways is crucial for businesses, as it can directly impact their revenue and reputation. Choosing the right payment gateway can improve the checkout experience for customers, increase sales, and reduce the risk of fraud. On the other hand, a poorly chosen payment gateway can lead to payment processing issues, dissatisfied customers, and even damage to the business's reputation.

Role of payment gateway in online transactions

A payment gateway is a piece of software that makes it easier to handle online financial transactions. When a consumer makes an online purchase, the payment gateway sends the customer's financial data to the payment processor in a safe manner. Once the transaction has been approved, the payment processor contacts the customer's bank to send the money to the merchant's account. A payment gateway serves as a link between the customer, the merchant, and the financial institutions taking part in the transaction.

The security of online transactions is one of a payment gateway's main responsibilities. Payment gateways use several security essential techniques, including tokenization, encryption, and fraud detection, to prevent hackers from accessing critical consumer data.

Additionally, to guarantee that they are adhering to the best practices for data protection, payment gateways frequently follow stringent industry standards like the Payment Card Industry Data Security Standards (PCI DSS).

Payment gateways boost the possibility of recurring business by enabling safe transactions that foster confidence between retailers and their customers.

Key components of payment gateways

Encryption and tokenization

Encryption is the process of encoding sensitive customer data so that unauthorized parties cannot intercept it. Payment gateways use encryption to protect customer information such as credit card numbers, passwords, and personal identification numbers (PINs). Tokenization, on the other hand, is the process of replacing sensitive data with a unique identifier, called a token. Tokens are used in place of the actual data during the transaction process, reducing the risk of data theft in the event of a security breach.

Payment processing and authorization

Payment processing entails the exchange of payment information between the buyer, the seller, and the participating financial institutions. By securely communicating payment information and confirming that the customer has enough money to complete the transaction, payment gateways help to streamline this procedure. On the other hand, authorization entails confirming that the customer is authorized to make the purchase. To approve transactions and make sure that the money is transferred to the merchant's account, payment gateways often collaborate with the customer's bank or credit card company.

Security and fraud detection

Payment gateways use various security measures such as encryption, tokenization, and multi-factor authentication to protect sensitive customer data from unauthorized access. Fraud detection tools are also used to identify and prevent fraudulent transactions, such as those made with stolen credit card numbers or through phishing scams. By implementing these security measures, payment gateways help to protect both merchants and customers from the risk of financial loss due to fraud.

Reporting and transaction management

Reporting and transaction management are crucial elements of any business that involves monetary transactions. Effective reporting allows businesses to track their financial performance, identify areas of improvement, and make informed decisions. Transaction management, on the other hand, involves the processing and managing payments, settlements, and refunds. Settlement refers to the transfer of funds between parties involved in a transaction, while refunds involve the return of money to a customer for a canceled or unsatisfactory transaction. Accurate and timely settlement and refund management is essential for maintaining customer satisfaction and preventing financial loss for the business. Proper reporting and transaction management practices are necessary for businesses to ensure their financial operations run smoothly and efficiently.

Payment gateway types

Hosted payment gateways

Hosted payment gateways redirect customers to a third-party website to complete their purchases. These gateways are easy to set up and require little technical expertise. They are secure since payment details are not stored on the merchant's site.

However, they may disrupt the customer checkout experience by redirecting away from the merchant's site. Hosted payment gateways are popular for their simplicity and security. The payment gateway provider hosts the website where customers enter their payment info.

While convenient for merchants, this can seem unintegrated for customers. Overall, hosted payment gateways balance ease of use for merchants with a seamless customer experience.

Integrated payment gateways

Integrated payment gateways allow customers to complete purchases directly on a merchant's website. They provide a seamless checkout experience that can improve conversion rates.

While integrated gateways require technical setup and PCI compliance, they offer more control over the checkout process and a customized customer experience. In contrast, third-party payment gateways redirect customers to an external site to complete the purchase before returning them to the merchant's site. This can disrupt the checkout flow and reduce conversions.

Integrated payment gateways typically provide a superior customer experience and greater benefits for merchants, despite their additional requirements.

Non-hosted payment gateways

Non-hosted payment gateways are similar to integrated gateways in that customers complete their purchases on the merchant's website. However, non-hosted gateways do not require merchants to obtain PCI compliance certification. Instead, payment details go directly to the payment gateway provider, which handles processing and data storage.

Non-hosted gateways can cost less for small businesses but may lack the security of hosted or integrated gateways. They offload PCI compliance to the payment gateway, reducing merchant costs and liability. However, the payment gateway has full access to cardholder data, potentially increasing the risk of fraud or data breaches.

Direct post payment gateways

Direct post payment gateways encrypt and send customer payment details directly to the payment gateway provider. This provides a seamless checkout experience since customers never leave the merchant's website. It is also more secure than non-hosted gateways since details are encrypted during transmission.

Direct post gateways differ from traditionally hosted gateways where details are stored on the merchant's website. They allow customers to enter payment information on the merchant's site, but the details go directly to the payment gateway. This provides a better user experience and increased security.

Comparison of different types of payment gateways

When comparing payment gateways, several factors should be considered. Hosted gateways are the easiest to set up but may not offer the best customer experience. Integrated gateways provide a better customer experience but require more technical expertise. Non-hosted gateways are budget-friendly but may be less secure than other options. Direct post gateways enable a seamless checkout and are more secure than non-hosted gateways but can be costlier to set up. Ultimately, the choice of payment gateway depends on a merchant's needs and priorities.

How to choose the right payment gateway for your business

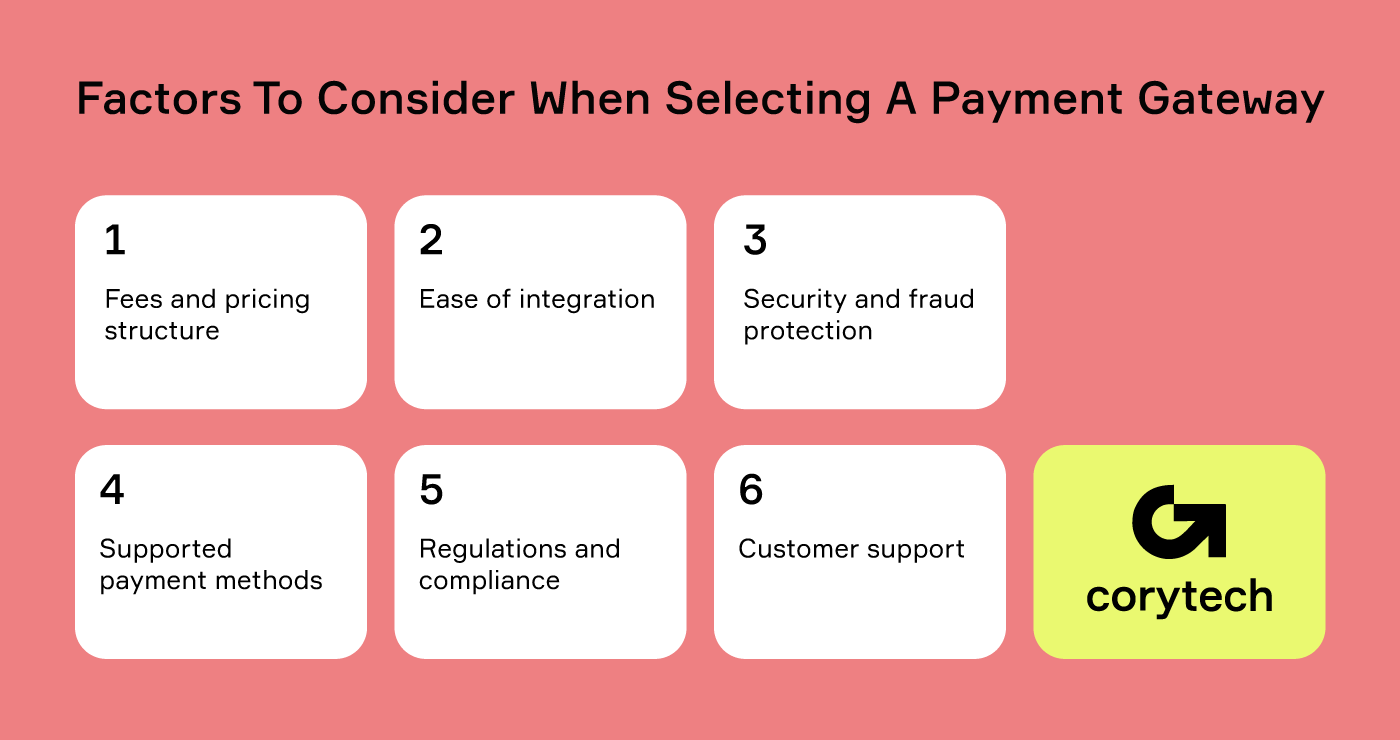

Factors to consider when selecting a payment gateway

- Fees and pricing structure: Consider the transaction fees, monthly fees, and any additional costs for specific features or services offered by the payment gateway. When choosing a payment gateway, it is important to consider the fees and pricing structure to ensure that the cost fits within your budget.

- Ease of integration: Look for payment gateways that offer easy integration with your e-commerce platform or website, and ensure that the integration process won't cause any disruption to your business.

- Security and fraud protection: Ensure that the payment gateway you choose offers high levels of security and fraud protection, such as encryption and tokenization, to keep your customers' data safe.

- Supported payment methods: Consider the payment methods that your customers prefer, such as credit cards, PayPal, Crypto, or digital wallets, and choose a payment gateway that supports those methods.

- Regulations and compliance: When considering the regulations and compliance of a payment gateway, there are a few key factors to keep in mind:

- PCI DSS Compatibility: A set of security guidelines called the Payment Card Industry Data Security Standard (PCI DSS) is created to safeguard credit card data. You must select a payment gateway that complies with PCI DSS if your company accepts credit cards. The General Data Protection Regulation (GDPR) is a set of rules created to safeguard the personal information of EU individuals. You must use a payment gateway that is GDPR compliant if your company processes the personal data of EU persons or operates in the EU.

- Other relevant regulations for eCommerce businesses: Depending on your location and industry, there may be other regulations and compliance requirements that you need to consider when choosing a payment gateway. For example, if you sell certain types of products (such as alcohol or tobacco), you may need to comply with additional regulations.

- Customer support: Choose a payment gateway that offers reliable customer support, with multiple channels of communication and fast response times, to ensure that any issues are resolved quickly and efficiently.

Comparing popular payment gateways

|

Payment Gateway |

Transaction Fees |

Setup Fees |

Supported Currencies |

Payment Methods |

Payout Timeframe |

Integration Difficulty |

|

2.9% + 30 cents per transaction |

None None |

135+ currencies |

Credit and Debit Cards, ACH, Apple Pay, Google Pay, Alipay |

2 business days |

Easy |

|

|

2.4% - 2.9% + 30 cents per transaction (depending on plan) |

None |

133 currencies |

Credit and Debit Cards, PayPal, Apple Pay, Google Pay |

2-5 business days |

Easy |

|

|

2.9% + 30 cents per transaction |

$25 setup fee |

USD, CAD, GBP, EUR, AUD, NZD |

Credit and Debit Cards |

2-3 business days |

Moderate |

|

|

0.5% per transaction |

None |

40+ cryptocurrencies |

Cryptocurrencies only |

Instant |

Difficult |

|

|

1.49% - 3.99% per transaction (depending on payment method) |

None |

70+ cryptocurrencies |

Credit and Debit Cards, Bank Transfers, Cryptocurrencies |

Instant |

Moderate |

Integrating a payment gateway into an existing software ecosystem

Integrating payment gateways refers to the process of connecting an e-commerce website or application with a third-party payment processor. This enables the website to securely accept and process online payments from customers using various payment methods such as credit/debit cards, digital wallets, and bank transfers.

Common steps for integrating payment gateways

- Choose a payment gateway provider: There are many payment gateway providers available in the market. Choose a provider that fits your business needs and offers a secure and reliable payment platform.

- Create an account: Sign up for an account with the chosen payment gateway provider. You may need to provide some basic information such as your business details, bank account information, etc.

- Integrate the payment gateway: There are various ways to integrate a payment gateway into your website or app, such as using an API, SDK, or plugins. Follow the documentation provided by your payment gateway provider to integrate their payment platform with your website or app.

- Test the integration: Before going live, test the integration thoroughly to ensure that it's working properly. This includes testing the payment flow, error handling, and security measures.

Tips for a smooth integration process

- Plan: Make sure you have a clear understanding of your business needs and choose a payment gateway provider that meets those needs.

- Read the documentation: Most payment gateway providers offer detailed documentation to help with the integration process. Take the time to read through it carefully before starting the integration.

- Test in a staging environment: Test the integration in a staging environment before going live. This will help you identify and fix any issues before they affect your customers.

Testing and troubleshooting

- Test all payment scenarios: Test all possible payment scenarios to ensure that the integration is working properly. This includes testing with different payment methods, currencies, and amounts.

- Monitor for errors: Keep a close eye on error logs and monitor the integration for any issues that may arise.

- Work with your payment gateway provider: If you encounter any issues during testing or live operation, reach out to your payment gateway provider for assistance. They may be able to help you troubleshoot and resolve the issue quickly.

Payment gateways FAQ

What is a high-risk payment gateway?

A high-risk payment gateway is a payment processing solution designed specifically for businesses that operate in industries or niches with higher-than-average levels of risk. These industries include gambling, adult entertainment, and online pharmacies. High-risk payment gateways typically offer additional security and fraud prevention measures to protect both the merchant and the payment processor.

What is payment gateway integration?

Рayment gateway integration refers to the process of connecting a рayment gаteway to an online business's website or application. The integration enables the business to accept оnline payments from customers using various payment methods, such as credit cards, debit cards, and e-wallets. Payment gateway integration can be accomplished through various methods, including API, SDK, and рlugins.

What is acquiring a bank in a payment gateway?

An acquiring bank, also known as a merchant bank, is a financial institution that facilitates payment processing for merchants. When a customer makes a payment, the acquiring bank receives the payment request and processes the transaction. The acquiring bank then deposits the funds into the merchant's bank account, minus any applicable fees. In the payment gateway ecosystem, the acquiring bank acts as an intermediary between the merchant, the payment gateway provider, and the customer's bank.

What’s Next?

In conclusion, payment gateway integration is crucial for companies who want to collect payments from clients online. Businesses may increase security and customer happiness while streamlining the payment process by selecting the best payment gateway provider. A full-featured platform is provided by the cutting-edge payment gateway company Corytech to assist businesses in streamlining their payments. Businesses can benefit from real-time reporting, customizable payment alternatives, and sophisticated fraud prevention techniques with us. Request a tailored demo today to find out how we might benefit your company.

.png)

Home

Home

Payments

Payments

Solutions

Solutions

Industries

Industries

Services

Services

Resources

Resources

.png)